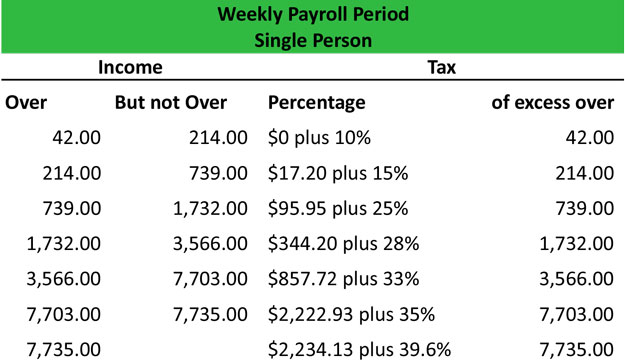

12.5 Record Transactions Incurred in Preparing Payroll - Principles of Accounting, Volume 1: Financial Accounting | OpenStax

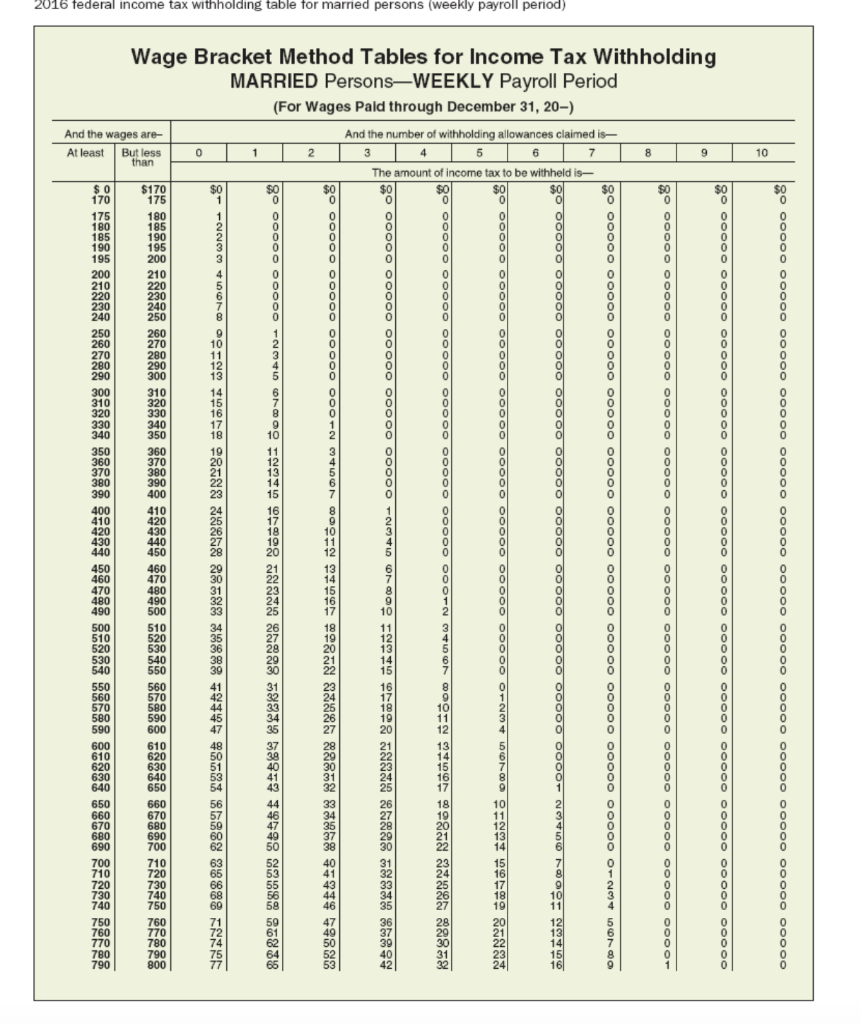

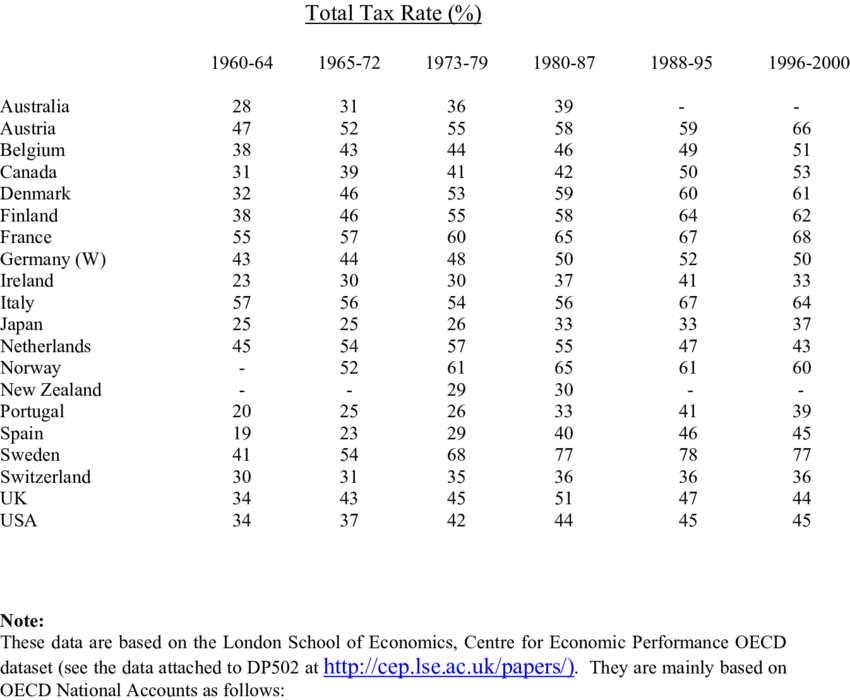

The Treasury Department Just Released Updated Tax Withholding Tables That Will Change Your Paycheck – Mother Jones